Substantial potential upside value

Valeura identified the potential for a deep tight gas play early in its entry into the Thrace Basin. Based on this thesis, the Company acquired the Banarli Exploration Licence in 2013 (adapted to two licences in 2015) and drilled the Kanzanci-5, Hayrabolu-10, and Yayli-1 wells to depths of 2,900 – 4,000 metres, into over-pressured sands, which provided more evidence supporting the play.

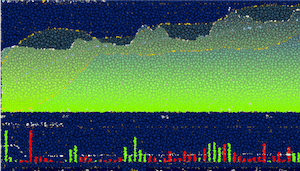

Under the Banarli Farm-In, the Company acquired approximately 500 square kilometres of 3D seismic (Karaca) and drilled the Yamalik-1 exploration well, fully funded by its joint venture partner at the time, as the first well testing the deep, tight gas thesis, into an area with no identified structural closure by design. The well encountered highly over-pressured gas saturated Mezardere and Kesan formations from approximately 2,900 metres down to the total depth of 4,196 metres. The over-pressure at the total depth was greater than 0.8 psi/ft based on testing results. The average net sand in the objective section was approximately 44 per cent.

In the fourth quarter of 2017, Valeura completed four production tests in the Kesan formation in the Yamalik-1 well, where each test was preceded by two slick-water high-pressure stimulations. The testing successfully demonstrated that gas and condensate would flow to surface post- high-pressure stimulation and a 24-hour aggregate production test rate of 2.9 MMcf/d was achieved. The gas flowed with a significant amount of condensate (with a test data range of 20 to 70 barrels per MMcf). The ability to flow high-pressure gas from an area outside of a structural closure supported the interpretation of a deep, tight gas play.

Activities in 2018 focused on the planning and commencement of an appraisal programme for the play, following the Yamalik-1 discovery, to determine whether the over-pressured gas is pervasive across the basin and to demonstrate that the gas could be flowed commercially. The notional programme agreed with partners was to drill appraisal wells, including the second commitment well under the Banarli Farm-in, which would be high-pressure stimulated and tested if successful, and a notional plan to further production test one or two historic wells.

In September 2018, Valeura recompleted Yamalik-1 and tied-in the well to allow for loner-term production testing on a comingled basis. At the end of 24 hours of continuous production, the flow rate was 2.53 MMcf/d through a 20/64” choke with a wellhead pressure of 2,535 psi. After a period of intermittent flow of gas, condensate, and water, a gas lift compressor was installed to assist in the ongoing flow back of stimulation fluids phase of initial production. Pressures and flow rates stabilised after the introduction of gas lift, and the well continued to flow a mixture of gas, condensate and water.

The first appraisal well, Inanli-1, funded by Valeura’s joint venture partner, was spudded in October 2018. The well was approximately 6 km from Yamalik-1 and the key objectives were to determine whether the over-pressured, gas-bearing reservoir discovered in Yamalik-1 is laterally continuous, to test for effective reservoir and over-pressured gas at deeper depths than Yamalik-1, and to test for the presence of enhanced natural fracturing in the reservoir. Drilling operations carried into January 2019 when the well reached total depth at 4,885 metres. Based on drilling and wireline logging data, the well is interpreted to have intersected over-pressured tight gas below 3,270 metres down to the total depth. Four intervals were subsequently stimulated and tested, each demonstrating stable gas production and providing evidence of both fracture and matrix contributions to gas flow.

The second appraisal well, Devepinar-1, funded 31.5 per cent by Valeura, is located 20 kilometres west of Yamalik-1 and Inanli-1 and was spudded in late February 2019. The well was drilled to 4,796 metres, and encountered clear indications of over-pressured gas throughout a 1,066 metre gross column in the Teslimkoy and Kesan Formations. The well met all of its drilling objectives and most significantly, confirmed the presence of over-pressured, gas-bearing reservoir at the western flank of the mapped play fairway. Three intervals were stimulated in the well, and were production tested on a comingled basis, demonstrating dry gas flow to surface, and subsequently tested again in Q1 2020 which demonstrated similar flow characteristics.

In Q2 2020, Valeura integrated all learnings from the drilling and testing of the Inanli-1 and Devepinar-1 wells. The Company has observed that the best reservoir quality in all wells is encountered in the upper few hundred metres of the Kesan Formation. However, the best gas flow results have been achieved deeper in the wells, where the gas is very dry and flows without condensate and minimal water – as seen in the first production test in Inanli-1 at approximately 4,275 metres. The Company intends for the next appraisal wells to target sweet spots which have both of these characteristics; in particular, locations that are closer to the centre of the basin where the high quality reservoir at the top of the Kesan Formation is deeper, and therefore within the dry gas maturity window. Final well locations within this broader area will then focus on regions of more intense natural fracturing, as interpreted on 3D seismic data.

Valeura intends to farm out a portion of its interest in the tight gas play, and has engaged Stellar Energy Advisors Limited, with a mandate to secure a partner with technical and commercial expertise suited to a tight gas appraisal play of this magnitude. With the addition of a new partner, Valeura will be poised to resume appraisal activities rapidly.