- About

-

-

-

Valeura Energy Inc. is an upstream oil & gas company, with a clear strategy to add value for shareholders. The Company is well-positioned both for organic growth and for potential further inorganic growth, and maintains a continual focus on operational excellence.

- Corporate Profile

- History

-

-

Sean Guest, President and CEO

- Management

- Board of Directors

-

-

- Operations

-

-

-

Valeura holds a portfolio of operated oil-producing assets in the offshore Gulf of Thailand and seeks to grow its operational presence both through organic development and through the mergers and acquisitions market in Southeast Asia. In addition, the company holds an operated interest in a deep, tight gas appraisal play in the Thrace Basin of north-west Turkey.

- Reserves and Resources

- Turkey

-

-

-

-

- Sustainability

-

-

-

Valeura Energy has prepared its inaugural Sustainability Report to share its baseline data and performance objectives relating to the ongoing sustainability of its business. In particular, this report addresses the most significant matters across environmental, social, and governance dimensions.

- Sustainability Report

- Environment

- Governance

- Health, Safety and Sustainability Policy

-

-

-

-

- Investors

-

-

-

Valeura conducts a professional Investor Relations programme, aimed at providing timely and relevant information to the global investment community. Our team strives to be best-in-class with regards to accessibility for investors.

- Presentations

- Financials

- News

- SEDAR

- Calendar

-

-

-

-

- Careers

- Contact

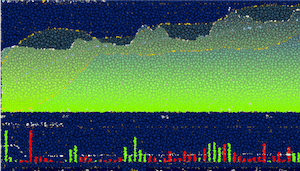

Quotes provided by TradingView